Tax Credits & Utility Rebates

Federal Tax Credits

Heat pumps

Heat pumps qualify for a tax rebate of 30% of the project cost, with a $2,000 annual cap. Note, this is a tax credit and may not provide a benefit if you are retired and/or do not have income. The tax credit applies to air source heat pumps (a regular heat pump) and heat pump water heaters. The credit is allowed for qualifying property placed in service on or after January 1, 2023, and before January 1, 2033.

Tax Credit Requirements

All items must meet minimum efficiency standards. While the vast majority of items we sell and install meet the criteria, it’s important to verify the specific model number. Our quote should indicate whether your equipment meets the standard. The AHRI website maintains the current list of approved equipment. Click on the blue boxes on the right side to download a list of model numbers.

PSE Rebates

Converting from natural gas furnace to a heat pump

- This rebate has recently expired.

Converting from electric resistance heaters (baseboard, wall heaters, etc.)

- $1,500 standard rebate

- $2,400 efficiency boost for low & moderate income households

- Customers with a gas furnace or existing heat pump are not eligible. The rebate is only for conversion from electric resistance heat to a heat pump.

Do I qualify? Equipment requirements

- You must be a PSE electricity customer

- Customers with pre-existing heat pumps are not eligible.

- Your heat pump must service the main portion of the home. Heating a single room does not qualify.

- Heat pumps must be installed to comply with all federal, state, and local code requirements.

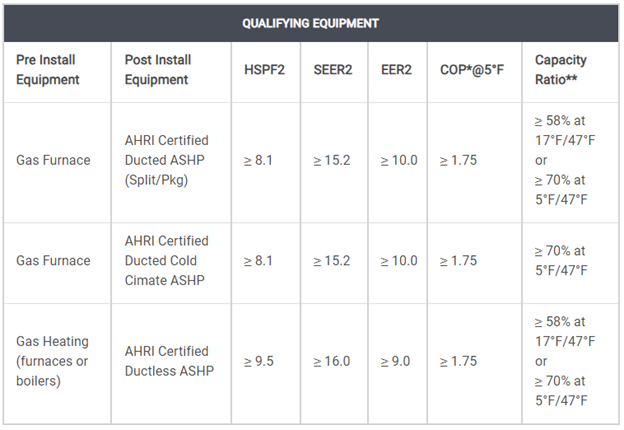

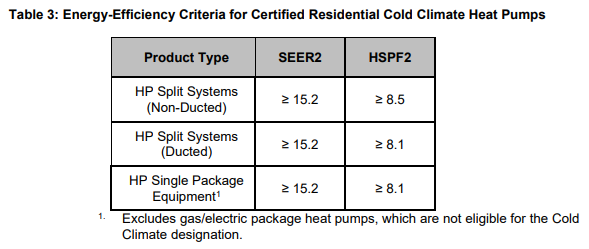

Customers must install an AHRI Certified® heat pump system that qualifies for the IRA Tax Credit, meeting CEE specifications. - Qualifying equipment models can be found here. Cold Climate eligible heat pumps are designated under the “Cold Climate?” column and are consistent with ENERGY STAR® v6.1 Energy-Efficiency Criteria for Certified Cold Climate Heat Pumps.

- If your system is not listed on the qualifying products list, it may be eligible for an incentive if it meets the requirements listed below as tested and rated by AHRI per current CEE US Department of Energy test procedures.

FAQs:

I have gas furnace, should I go with a pure heat pump or dual gas/heat pump combo?

This mostly depends on the size of the home. For smaller homes, a pure heat pump system works well and a backup electric strip heater will handle the cold days.

This approach doesn’t work well for larger homes. Therefore, if you forego a gas furnace, you’ll need to select a heat pump capable of operating in cold temperatures. These are much more expensive and the cost increase will exceed the rebate ($2,400). You’re better off foregoing the rebate and installing a dual fuel gas/heat pump combo. In the end, you’ll spend the same and have a much more effective and durable solution.

Application Requirements

- You will need an electronic image of your paid installation invoice and a purchase receipt for your installed equipment. These documents must include an installation date, installation address, brand, model number(s) of all rebated equipment (include the heat pump, air handler and/or coil model number on the invoice), and the amount paid.

- Your rebate application must be submitted within 60 days of installation.

- Only one rebate will be issued per qualified single-family residence.

- You must have an online PSE account to apply online.

- Rebates are only available on new, qualifying equipment. Rebates cannot exceed the pre-tax purchase price of any rebated equipment. Equipment that is replaced under warranty will not be eligible for a second rebate.

- Equipment must be installed on or after June 19, 2023.

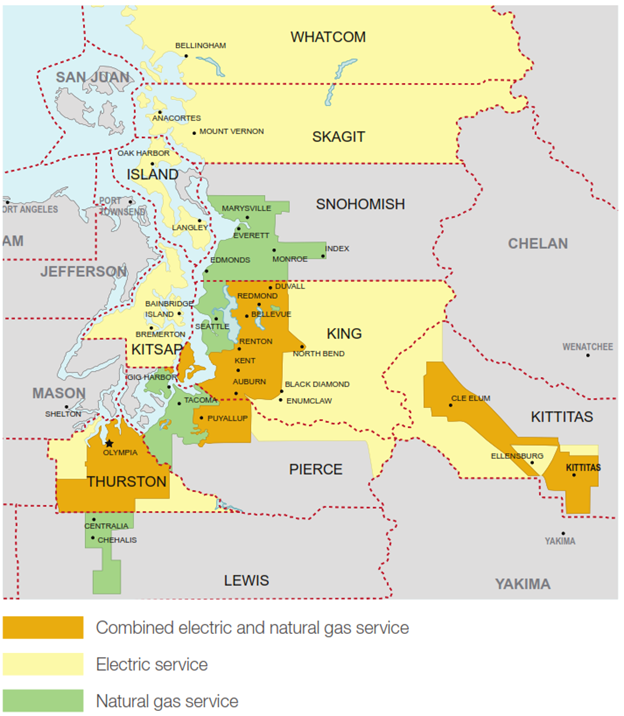

PSE Customer Map

Minimum efficiency requirements for cold climate heat pumps